Jacob Ng

1. Start with a Budget

Let’s start with the foundation of financial awesomeness - budgeting! Creating a budget might not sound thrilling but it’s like having a roadmap to financial freedom. Unsure where to begin? You can follow the allocation model below! If you do not have any loans to repay, consider channelling your budget towards savings or investments.

2. Escape the Debt Trap

Debt can be a formidable foe, but with a strategic approach, you can conquer it. Ideally, avoid accumulating a debt. However, if you are already in debt, prioritise paying off high-interest debts first while making minimum payments on others. Refrain from adding more debt to the mix, and with each payment made, you’ll edge closer to financial liberation.

3. Build an Emergency Fund

Life is unpredictable, so it’s essential to have a safety net in place. Establish an emergency fund with at least three to six months’ worth of living expenses. This fund will act as your financial shield, protecting you from unexpected events and providing a peace of mind.

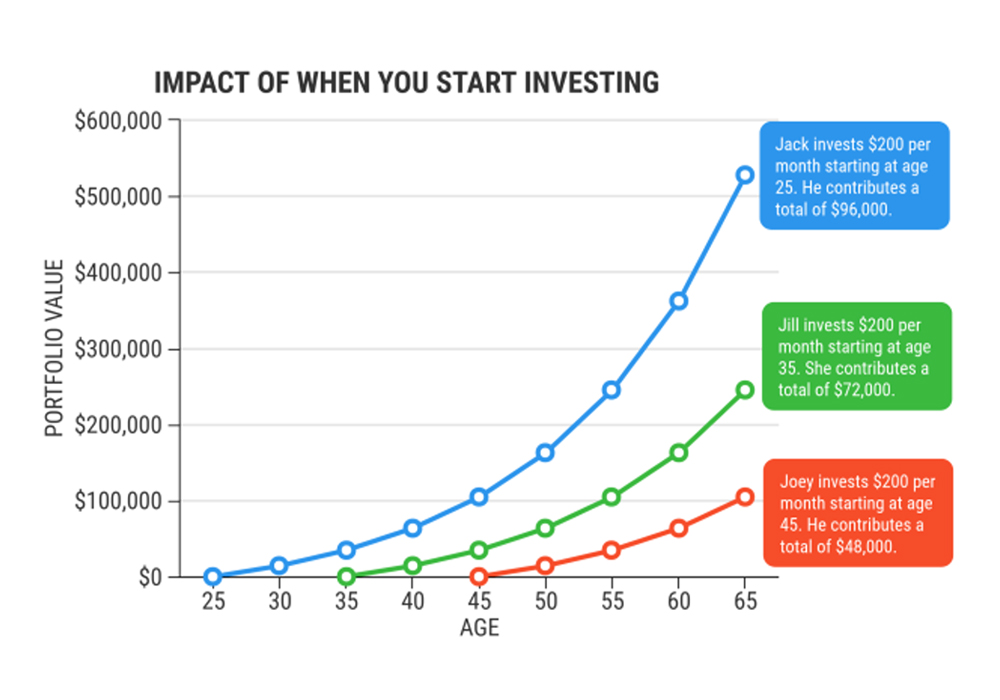

The graph demonstrates how a monthly investment of $200, initiated at various ages, can impact your portfolio value over time.

4. Invest for Your Future

Investing may sound intimidating but it’s a powerful tool to grow your wealth, especially when you are young and have many years ahead for the compounding effect to work. Educate yourself about various investment options, such as stocks, bonds, and unit trusts. You can also speak to a trusted advisor to demystify the complexities.

5. Protect Your Health and Future

While investing in financial assets is crucial, don’t neglect insuring yourself. Secure health insurance, life insurance, and critical illness coverage to protect yourself and your loved ones. Having a perfect armour for life’s uncertainties will allow you to face challenges with confidence.

6. Regularly Review Your Finances

Money management is an ongoing process. Schedule regular “financial check-ups” with your advisor to review your progress, adjust your budget, and reassess your financial goals. Being proactive and staying on top of your finances will empower you to make informed decisions.

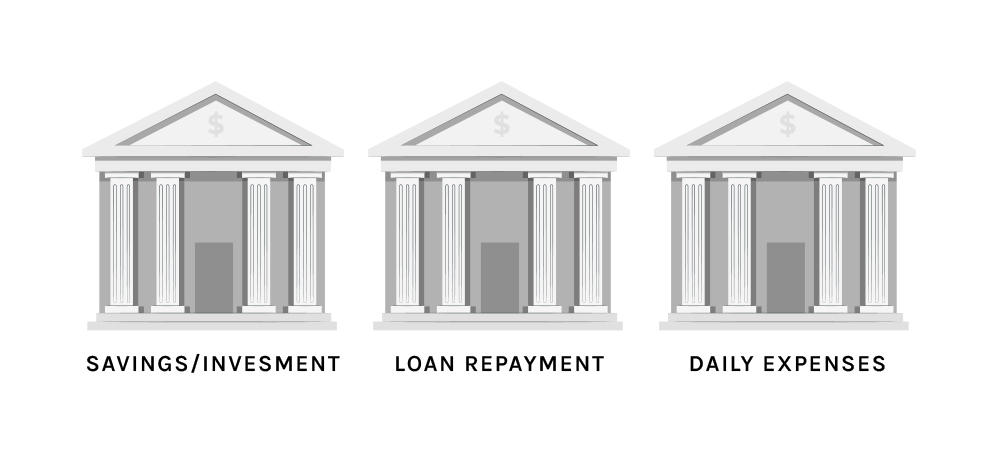

7. Divide and Conquer

The simplest and most effective money management system is to have separate bank accounts for your respective budgeting allocations. Automatic income division simplifies financial control. In most cases, we should allocate accounts for savings/investment account, loan repayment and daily expenses for smoother management.

8. Embrace Retirement Planning

Retirement may seem distant, but it’s never too early to start planning for it. Take advantage of the various government schemes like Central Provident Fund (CPF) and Supplementary Retirement Scheme (SRS) to set aside funds for your golden years while reducing your tax liabilities. The sooner you begin, the brighter your retirement will shine!

By following these money management tips you’ll be embarking on a journey to financial independence. Remember, building financial security takes time and discipline, so be patient and stay committed to your goals. Here’s a bonus tip: While budgeting helps you manage your expenses, the faster way to achieve financial independence is through increasing income. By starting a side hustle, you can be sure that you will achieve your financial independence much faster.

Jacob Ng is an authorised representative of AIA Financial Advisers Private (Reg. No. 201715016G)

*This presentation is for informational purposes only. The content represents the Financial Consultant’s views, and not AIA FA’s official stance, and should not be reproduced without prior permission.